Monday 27 February 2017

7th Pay Commission: Announcement for higher allowances after Assembly election results

New Delhi, February 25: Almost eight months have been passed now and the Central government employees are waiting to receive higher allowances under the 7th Pay Commission recommendations in their paychecks. Some reports suggest that the government is likely to make an announcement on higher allowances after assembly elections results of five states which will be declared on March 11.

In June 2016, the union government approved the recommendations made by the high-powered committee on 7th Pay Commission and promised to pay higher basic pay with arrears, effective from January 1, 2016. But the hike in allowances other than the Dearness Allowances (DA) is yet to materialise.

The recommendations made by the 7th Pay Commission was wrapped up in June 2016, but more than 53 lakh central government employees are not given any assurances, as they are still waiting for payments owed them ie: higher allowances.

Some reports suggest that the delays are because the ‘Committee on Allowances’ headed by Finance Secretary Ashok Lavasa had recommended to abolish 51 allowances and subsuming 37 other allowances out of 196 allowances.

Earlier the Committee on Allowances were initially given a time of four months to submit its report to Finance Minister Arun Jaitley. In October 2016, Ashok Lavasa was quoted by some media organisation saying he was ready with the report.

However the committee was given an extension till February 22, 2017, to submit its report in the backdrop of demonetisation and the government said that the cash crunch was the reason behind the delay in announcing the higher allowances.

Once the Assembly elections are over in five states, the government is likely to clear the nod to revise allowances. Some reports suggest that the revised allowances are expected to be effective from April 1, which marks the beginning of the new financial year.

According to The Sen Times report, which quoted a source said that the report on Committee on Allowances states the current HRA slab is 30 per cent of the basic pay for metros. An announcement on the same is expected soon.

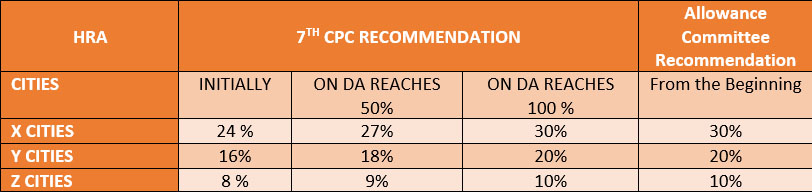

On the other side, the 7th Pay Commission had recommended reducing the house rent allowance (HRA) to 24 per cent of basic pay as against the 30 per cent of basic pay employees were drawing under the 6th Pay Commission.

Read at:http://www.india.com

Sources Confirmed Allowance Committee Report Submitted

One of the NJCA leader, On Condition of Anonymity, told that the committee constituted to examine the allowance has finalized its reports and submitted it to the Government on 22nd February 2017.

On asking whether the NJCA knew the details of the committee report, he said that they were not provided with the committee report. But the committee has informed them that their demand on allowance would be considered favorably.

Hence it is expected the HRA will be retained in old rates (Sixth CPC rates) from the beginning itself and will be paid in 7th CPC Pay Scale when revised allowances come into effect. However, the news of revised allowances would be implemented with effect from 1.4.2017 is not reliable. NJCA will not accept this and clearly said that it should be implemented with effect from 1.1.2016 retrospectively.

X cities- 30%

Y cities- 20%

Z cities- 10%

Y cities- 20%

Z cities- 10%

Transport Allowance may be split into two elements as CCA and TA as it was paid in fifth CPC. The Rates will be delinked from DA and will Fixed in slab rates.

The Government will announce its decision over the committee report after the last phase of state elections ie after 8th March 2017.

Source: Govtstaffnews.in

Saturday 25 February 2017

7th Pay Commission – Bunching of stages in the revised pay structure under CCS(Revised Pay) Rules, 2016

No.A-60015/1/2016/MF.CGA(A)/NGE/7th CPC/6010

Government Of India

Ministry Of Finance

Department Of Expenditure

Controller General Of Accounts

Mahalekha Niyantrak Bhawan

E Block, GPO complex, INA

New Delhi – 110 023

Dated: 23rd February,2017

OFFICE MEMORANDUM

Sub: Recommendations of 7th Central Pay Commission – Bunching of stages in the revised pay structure under Central Civil Services (Revised Pay) Rules, 2016.

Consequent to the issue of implementation Cell, Department of Expenditure OM No.1-6/2016-IC dated 7th September,2016, a number of representations have been received from AAOs under this organization through their respective Min./Deptt. regarding fixation of pay by bunching of stages in comparison with Sh.Babu Balram Jee, AAO, CPWD, IBBZ-I, Malda M/o UD in terms of the OM ibid. With a view to facilitate the accounting organisations under CGA, the service Book of Sh. Babu Balram Jee, AAO duly audited has been obtained from the M/o UD. The Pay details of Sh.Babu Balram Jee, AAO are as follows:

| 1 | Basic pay (Pay in the pay Band plus Grade Pay) in the pre revised structure on 1.1.2016: | Rs. 14900/- (Rs.10100 + Rs.4800) |

| 2 | Revised Basic Pay on 1.1.2016 in terms of Revised Pay Rules, 2016: | Rs. 47600/- (1st Cell of 8th Level) |

All respective accounting units of Ministries/Departments concerned may extend the benefit of bunching to eligible persons in adherence to the Department of Expenditure OM No.1-6/2016-IC dated 7th September, 2016. The statement of pay fixation under Central Civil Services (Revised Pay) Rules, 2016 of Sh.Babu Balram Jee, AAO is also enclosed.

This issues with the approval of the competent authority.

(Sandeep Malhotra)

Sr.Accounts Officer

Encl: As above.

Statement of Fixation of Pay under Central Civil Service (Revised Pay) Rule, 2016

Thursday 23 February 2017

Wednesday 22 February 2017

Directorate Clarification on Bench Mark for promotion

Directorate Letter No. 20-45/2016-SPB-II dated 18th Feb 2017 regarding clarification on Benchmark for Promotion.

7th Pay Commission: Committee on Allowances to submit report today and allowance hike from April 1, says NJCA chief

7th Pay Commission: Committee on Allowances to submit report today and allowance hike from April 1, says NJCA chief

NJCA chief Shiv Gopal Mishra confirmed that the allowances report would be submitted on Wednesday.

New Delhi, Feb 21: Committee on allowances, headed by Finance Secretary Ashok Lavasa, will submit its report tomorrow, claims National Joint Council of Action (NJCA) convenor Shiv Gopal Mishra. Central government employees were expecting the report to be tabled by Monday. However, the committee delayed the submission due to unspecified reasons. The report would pave the way for the implementation of hiked allowances as per the revised 7th Pay Commission recommendations.

“Government has made no announcement yet. But the report by Committee on allowances would be tabled tomorrow,” Shiv Gopal Mishra said, while speaking exclusively to India.com. On being asked whether the government would make an announcement in relation to the arrears on allowances, he replied, “Let us see what comes out of the report. We are expecting the hike in allowances, as per our demands. We have to wait and see whether the government makes an announcement on arrears as well.”

The committee on allowances was formed in July 2016, after central government employees raised several anomalies related to the 7th Pay Commission report submitted by Justice (retd) AK Mathur. The 7CPC report had recommended the abolition of 51 existing allowances, and subsumption of 37 others of the total 191 allowances.

The major point of grievance was the reduction in Housing Rent Allowance (HRA) offered to central government employees. As per the 6th Pay Commission report, the HRAs provided were 30 per cent, 20 per cent, 10 per cent for employees living in ‘X’, ‘Y’, ‘Z’ category towns/cities. However, the 7th Pay Commission report decreased the allowances to 24, 16 and 8 per cent of the basic pay.

Reduction in HRA has irked a major section of central government employees, who reside in rented accommodations. A section of the aggrieved employees have blamed the top bureaucracy for the delay in HRA hike. “Naturally, the common central government employees are more affected by the delay in allowance hike. The top bureacrats don’t take higher allowances, therefore, they are not interested in the hike,” Mishra said.

Apart from the hike in allowances, central government employees have also demanded Centre to provide arrears on the allowances. Since the date of implementation of 7th Pay Commission was fixed as January 1, 2016, employees have demanded the release of arrears on allowances as well.

Although the government provided arrears on basic pay while hiking the salaries on July 1, indications have been made that no arrears would be released on allowances. NJCA has confirmed that the employee unions would launch protest across the nation if the allowances are hiked, without the arrears. “Arrears are unlikely, but protests would be launched if they fail to release (the arrears),” Mishra said.

The date of allowances hike is reported to be April 1. NJCA claims, through its sources, that the government would be implementing the allowance hike from April 1. “It is most likely that the government announces the hike by April 1,” Mishra confirmed.

Read at: India.com

Monday 20 February 2017

New list of CGHS Eye Hospitals in Chennai as on 8.2.2017

EXCLUSIVE EYE CENTRES – CHENNAI

UPDATED ON 8TH FEBRUARY 2017

Sl. /Name of the Hospital Address and Telephone No. Facilities Empanelled for

1. DR.AGARWAL’S EYE HOSPITAL LTD. GOPALAPURAM19, CATHERDRAL ROAD, CHENNAI-86044-28772877044-28115871

NON NABH

NON NABL

Notified on 17.11.2014

Extended upto 16.02.2017

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL.

Reinstated w.e.f.16.02.2016

2. DR.AGARWAL’S EYE HOSPITAL LTD. GOPALAPURAM

B-63,SIVA ELANGO SALAI, 70 FEET ROAD PERIYAR NAGAR, CHENNAI-82.

044-25507755

044-43515787

NON NABH

NON NABL

Notified on 17.11.2014

Extended upto 16.02.2017

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL

3. DR.AGARWAL’S HEALTH CARE LTD. – TAMBARAM

TDK TOWER, 6, DURAISWAMY REDDY STREET WEST TAMBARAM, CHENNAI-45

044-39916500

044-22264845

NON NABH

NON NABL

Notified on 17.11.2014

Extended upto 16.02.2017

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL

4. VASAN EYE CARE HOSPITAL ANNANAGAR

M-77, 3RD AVENUE, ANNANAGAR EAST, CHENNAI- 102

044-33724800

044-33724899

NON NABH

NON NABL

Notified on 17.11.2014

Extended upto 16.02.2017

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL.

Reinstated w.e.f. 31.05.2016

5. UDHI EYE HOSPITALS

9, MURRAYS GATE ROAD, ALWARPET, CHENNAI-18

044-42788844

044-43471111

NABH UPTO 22.11.2018

NON NABL

Notified on 23.01.2015

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL

6. A.G. EYE CARE HOSPITALS

No.106, R.K.MUTT ROAD, MYLAPORE, CHENNAI-4

044-44437171

90920771111

NON NABH

NON NABL

Notified on 24.02.2015

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL

7. UMA EYE CLINIC

182 PLOT No.995, ‘O’ BLOCK; 2nd AVENUE, ANNANAGAR, CHENNAI – 600 040

NABH UPTO 14.01.2019

NON NABL

Notified on 18.08.2016

EYE CARE AND ALL OTHER FACILITIES AVAILABLE IN THE HOSPITAL

7th Pay Commission: Committee on Allowances likely to present its report today, HRA 30% for metro expected, revised allowances from April 1

The Committee on Allowances, headed by Finance Secretary Ashok Lavasa, was given time till February 22 to present its report.

It has been nearly eight months since the Narendra Modi government cleared the recommendations of the Seventh Pay Commission .

After a long wait, the Committee on Allowances is likely to submit its report to Finance Minister Arun Jaitley on Monday.

The committee, headed by Finance Secretary Ashok Lavasa, was given time till February 22 to table its report.

The revised allowances are likely to be effective from April 1.

The house rent allowance (HRA), which forms a crucial part of government employees' salary, is expected to be fixed at 30 per cent of the basic pay for employees in metros which have a population of 50 lakh and above.

HERE IS ALL YOU NEED TO KNOW:

- The Seventh Pay Commission had recommended 24 per cent of the basic pay as HRA against the 30 per cent of basic pay under the Sixth Pay Commission.

- The Committee on Allowances was formed in July last year to review the recommendations of the pay commission after employees protested against the proposed slash in the HRA. The pay commission also recommended doing away with 53 of the 196 allowances and merging a few others.

- The committee was initially given four months to table its report, which was later extended to February 22, 2017. If reports are to be believed, the Central government is likely to move ahead with the committee's report after March 15 when Assembly elections will be over.

- If the government decides to pay a 30 per cent of basic pay as HRA to its employees, the cost estimate comes to Rs 29,300 crore in the first year.

- The hiked salary is given in two parts to government employees, in the form of basic pay and allowances.

- While the increase in basic pay is calculated on a back-date basis, making employees eligible for arrears, the hike in allowances is applicable from the date the government implements it. As a result, employees are not entitled to arrears in this case.

- It is widely believed that the government has effectively saved a lot of money this financial year by not making an announcement on allowances. Government employees, on the other hand, have expressed their disappointment over being denied their full remuneration over a prolonged period.

Source: IndiaToday, Yahoo News

Friday 17 February 2017

Rajya Sabha Q & A — on GDS designation etc

UNSTARRED QUESTION NO.220

TO BE ANSWERED ON 3RD FEBRUARY, 2017

CHANGING THE NAME OF POSTMAN AS POSTMASTER

†220. SHRI MOTILAL VORA:

Will the Minister of COMMUNICATIONS be pleased to state:

(a) whether Government has changed the designation of Postman distributing letters in villages to Postmaster;

(b) whether this change in designation has been done only in the State of Rajasthan or it has been done at national level;

(c) whether it is a fact that the pay scale of Postmaster ranges from ` 4500 to ` 13,000;

(d) whether this pay scale remains even lower than that a Central fourth class employee; and

(e) if so, the steps being taken by Government to provide proper pay scale to Postmaster distributing mails from one village to another?

TO BE ANSWERED ON 3RD FEBRUARY, 2017

CHANGING THE NAME OF POSTMAN AS POSTMASTER

†220. SHRI MOTILAL VORA:

Will the Minister of COMMUNICATIONS be pleased to state:

(a) whether Government has changed the designation of Postman distributing letters in villages to Postmaster;

(b) whether this change in designation has been done only in the State of Rajasthan or it has been done at national level;

(c) whether it is a fact that the pay scale of Postmaster ranges from ` 4500 to ` 13,000;

(d) whether this pay scale remains even lower than that a Central fourth class employee; and

(e) if so, the steps being taken by Government to provide proper pay scale to Postmaster distributing mails from one village to another?

ANSWER

THE MINISTER OF STATE (IC) OF THE MINISTRY OF COMMUNICATIONS &

MINISTER OF STATE IN THE MINISTRY OF RAILWAYS

(SHRI MANOJ SINHA)

(a) No, Sir. Gramin Dak Sevak Branch Postmaster (GDS BPM) or Gramin Dak Sevak Mail Deliverer distribute letters in villages.

(b) Does not arise in view of (a) above.

(c) No, Sir.

(d) Yes Sir. However, there is no comparison in the pay scales of these two cadres since Central fourth class (now termed as Multi Tasking Staff – MTS) are regular employees whereas Gramin Dak Sevaks are part-time sevaks.

(e) The allowances of Gramin Dak Sewaks are revised periodically as in the case of Central Pay Commission.

*****************

How to claim tax benefit on tuition fees under Section 80C

Sending kids to school has an inbuilt tax advantage for the parents as the tuition fee qualifies for tax benefit under Section 80C of the Income Tax Act, 1961. The amount of tax benefit is within the overall limit of the section of Rs 1.5 lakh a year.

For tax purposes, the fee (amount) reduces the total gross income, and thereby the tax liability. Say, you fall in the highest income slab and pay not only a 30.9 per cent tax rate, but also Rs 80,000 a year as schools fees, the tax saved would amount to Rs 24,720 in that year

Here's how to get the maximum benefit out of tuition fees.

Are all institutions eligible?

Tuition fees paid at the time of admission or anytime during the financial year to any university, college, school or educational institution based in India qualifies for tax benefit.

What kind of education?

It has to be a full-time education, including any play school activities, pre-nursery and nursery classes. The institution can be either private or a government sponsored one.

What is not covered?

At times, parents have to make payments, other than tuition fees, to the educational institutions. Payments like development fees or donation or capitation fees, etc., are not covered and do not qualify for tax benefit. Also, if you haven't paid the fees on time, the applicable late fee paid will not be eligible.

Tax benefit for how many children?

The benefit applies for the fees paid for up to two children. So if a couple has four children, both can claim tax benefit as both have a separate limit of two children each.

Which parent gets the tax benefit?

The parent who makes the payment gets the tax advantage. If both parents are working and pay taxes, both can claim individually up to the amount of fees paid.

If both are working and want to take the benefit under Section 80C for the amount paid by them respectively, they can do so. So if the fee paid is Rs 2 lakh, of which the father has paid Rs 50,000, while the mother has paid Rs 1.5 lakh, both can claim the amount individually as per the payment made by them.

Conclusion

As the upper limit for Section 80C tax benefit is Rs 1.5 lakh a year, see how much of that gets exhausted through tuition fees and then decide on further tax savers. While the tax benefit on tuition fees is incidental and helps you to save tax during the early days of your child's education, do not forget to create a long-term investment plan for his higher education.

Estimate the amount needed for higher studies and create a savings plan towards that goal, preferably through SIPs in 3-5 equity diversified mutual funds scheme. To ensure that the goal is met, do buy adequate life cover, preferably through a pure term insurance plan.

For tax purposes, the fee (amount) reduces the total gross income, and thereby the tax liability. Say, you fall in the highest income slab and pay not only a 30.9 per cent tax rate, but also Rs 80,000 a year as schools fees, the tax saved would amount to Rs 24,720 in that year

Here's how to get the maximum benefit out of tuition fees.

Are all institutions eligible?

Tuition fees paid at the time of admission or anytime during the financial year to any university, college, school or educational institution based in India qualifies for tax benefit.

What kind of education?

It has to be a full-time education, including any play school activities, pre-nursery and nursery classes. The institution can be either private or a government sponsored one.

What is not covered?

At times, parents have to make payments, other than tuition fees, to the educational institutions. Payments like development fees or donation or capitation fees, etc., are not covered and do not qualify for tax benefit. Also, if you haven't paid the fees on time, the applicable late fee paid will not be eligible.

Tax benefit for how many children?

The benefit applies for the fees paid for up to two children. So if a couple has four children, both can claim tax benefit as both have a separate limit of two children each.

Which parent gets the tax benefit?

The parent who makes the payment gets the tax advantage. If both parents are working and pay taxes, both can claim individually up to the amount of fees paid.

If both are working and want to take the benefit under Section 80C for the amount paid by them respectively, they can do so. So if the fee paid is Rs 2 lakh, of which the father has paid Rs 50,000, while the mother has paid Rs 1.5 lakh, both can claim the amount individually as per the payment made by them.

Conclusion

As the upper limit for Section 80C tax benefit is Rs 1.5 lakh a year, see how much of that gets exhausted through tuition fees and then decide on further tax savers. While the tax benefit on tuition fees is incidental and helps you to save tax during the early days of your child's education, do not forget to create a long-term investment plan for his higher education.

Estimate the amount needed for higher studies and create a savings plan towards that goal, preferably through SIPs in 3-5 equity diversified mutual funds scheme. To ensure that the goal is met, do buy adequate life cover, preferably through a pure term insurance plan.

Source : The Economic Times

Thursday 16 February 2017

Compassionate Appointments: A Comprehensive View - 2016

Article By

Ch. Srinivasa Rao

Founder-Editor, “HARMONY”

Formerly COA, CSIR-NGRI,

Hyderabad

Genesis

The Scheme for “Compassionate Appointment under Central Government” was consolidated and issued vide DoPT O.M. No. 14014/6/86-Estt.(D) dated 30-6-1987 and again in the year 1998. Currently, the consolidated instructions on Compassionate Appointments were issued vide DoPT O.M. No.F.No.14014/02/2012-Estt.(D) dated 16-1-2013. Subsequently a number of instructions on compassionate appointments have been issued. Contents of relevant Office Memoranda and Orders issued from time to time on the subject have been further categorised under various easy-to-comprehend heads and are presented for reference and guidance.

Object

The object of the Scheme is to grant appointment on compassionate grounds to a dependent family member of a Govt. servant dying in harness or who is retired on medical grounds, thereby leaving his family in penury and without any means of livelihood, to relieve the family of the Govt. servant concerned from financial destitution.

Applicability

The dependent family member means: (a) spouse; or (b) son (including adopted son); or (c) daughter (including adopted daughter); or (d) brother or sister in the case of unmarried Govt. servant; or (e) member of the Armed Forces referred to in (A) or (B) of this para, who was wholly dependent on the Govt. servant/member of the Armed Forces at the time of his death in harness or retirement on medical grounds as the case may be.

To this list, married son/daughter has also been added due to pronouncements of judiciary which was explained elsewhere.

To a dependent family member:

(A) of a Govt. servant who:

a) dies while in service (including death by suicide); or

b) is retired on medical grounds under rule 2 of the CCS (Medical Examination) Rules, 1957 or the corresponding provision in the CCS Regulations before attaining the age of 55 years (57 years for erstwhile Group D Govt. servants); or

c) is retired on medical grounds under Rules 38 of the CCS (Pension) Rules, 1972 or the corresponding provision in the CCS Regulations before attaining the age of 55 years (57 years for erstwhile Group D Govt. servants); or

Under this list, dependent family members of Govt. servant are also included which is detailed elsewhere.

(B) of a member of the Armed Forces who –

a) dies during service; or

b) is killed in action; or

c) is medically boarded-out and is unfit for civil employment

Common Cadre Staff

7th Pay Commission: Higher Allowances Report To Be Submitted On Feb 20

New Delhi: The ‘Committee on Allowances’ is likely to submit higher allowances report to Finance Minister Arun Jaitley on February 20 which is due for implementation from August 1, 2016.

Finance Minister Arun Jaitley formed ‘Committee on Allowances’ for examination of the recommendations of 7th Pay Commission on allowances other than dearness allowance.

48 lakh serving central government employees and 52 lakh pensioners will be impacted by the report, the Committee on Allowances is likely to ditto the 7th Pay Commission report, said the Finance Ministry sources.

The ‘Committee on Allowances’, headed by Finance Secretary Ashok Lavasa, was appointed in July 2016 for 4 months. Its terms was extended in December 2016 till February 22, 2017.

However, the Finance Secretary Ashok Lavasa said in October, “We are ready to submit our report, when the Finance Minister Arun Jaitley calls up.”

Finance Minister Arun Jaitley formed ‘Committee on Allowances’ for examination of the recommendations of 7th Pay Commission on allowances other than dearness allowance as the pay commission had recommended abolition of 51 allowances and subsuming 37 others out of 196 allowances.

The ‘Committee on Allowances’ recommendation will guide how the various allowances of central government employees will be revised. The report would also impact all states government employees after some modifications.

“The government plans to pay pay higher allowance, under 7th Pay Commission recommendations, with retrospective effect from August 2016, central government employees unions demanded for implementation of the allowances with retrospective effect from January 2016,” the sources told The Sen Times.

Until acceptance of the report of ‘Committee on Allowances’, the allowances are now paid to the Central government employees according to the 6th Pay Commission recommendations.

According to the Finance Ministry, after getting the report on the allowances, the Union cabinet is expected to give nod the higher allowances in mid-March after the completion of five states assemblies’ poll process as the model code of conduct has come into effect from January 4 and the higher allowances under 7th Pay Commission may be implemented from April this year.

TST

Tuesday 14 February 2017

Grant of Advances- 7th Central Pay Commission recommendations-Amendment to rules on Computer Advance to Railway servants

Ministry of Railways (Rail Mantralaya)

(Railway Board)

No.I/11-Part I

PC-VII No : 15/2017

RBE No. 10/2017

No. F(E) Spl./2016/ADV.4/1(7th CPC)

The General Managers and FA&CAOs

All Indian Railways & Production Units

(As per standard list)

Subject: Grant of Advances- Seventh Central Pay Commission recommendations-Amendment to rules on Computer Advance to Railway servants.

Consequent upon the decision taken by the Government on the recommendations of Seventh Central Pay Commission, the Ministry of Finance vide their OM No. 12(1)/E.II(A)/2016 dated 07.10.2016 have amended the eligibility criteria in the existing provisions relating to the grant of Personal Computer Advance.

2. Amendment conditions of grant of Computer Advance are as follows:

| Advance | Quantum | Eligibility Criteria |

| Personal Computer Advance | ƻ50,000/- or actual price of PC, whichever is lower. | All Government Servants |

| The Computer Advance will be allowed maximum five times in the entire service. | ||

| The other terms and conditions governing the grant of Personal computer advance shall remain unchanged. | ||

3. Further, Ministry of Finance in their ibid OM have also decided that the other interest bearing advances relating to Motor Car Advance and Motorcycle/Scooter/Moped Advance will stand discontinued.

4. The above mentioned OM of Ministry of Finance relating to grant of interest bearing advances will apply mutatis-mutandis to Railway employees also.

4.1 So far as the interest free advances are concerned, Bicycle and Warm clothing advances stands abolished for Railway employees also in terms of MoF’s decision.

4.2 Orders relating to other interest free advances will be issued separately by concerned Directorates.

5. Necessary Advance Correction Slip to the chapter XI of the Indian Railway Establishment Manual, Vol.I Revised Edition, 1989 will follow.

6. The revised orders are effective from 07.10.2016 i.e. the date of the issue of the aforesaid OM of the Ministry of Finance. Past cases where the advances have already been sanctioned under the provisions of earlier rules on the subject need not be reopened.

7. Please acknowledge receipt.

8. Hindi version will follow.

(A.C. Jain)

Dy. Director Finance (Estt.)

Railway Board

CLARIFICATION REGARDING PAY FIXATION UNDER 7TH CPC FOR THE POST OF NON-MATRIC MTS ‘TRAINEE’ APPOINTED ON COMPASSIONATE GROUNDS

CGDA

Ulan Batar Road, Palam, Delhi cantt – 110 010

No.AN/XIV/14164/7th CPC/Corrsp/Vol-I

Dated 01-02-2017

To

All PCsDA/CsDA/PCof a(Fys)Kolkata

Subject: Clarification regarding pay fixation under 7th CPC for the post of ‘Trainee’ appointed on compassionate grounds

This office is receiving several references from various controller offices seeking clarification regarding pay fixation under Seventh CPC in respect of “Trainee” appointed on compassionate ground without acquiring minimum educational qualification in the pay scale of Rs.4440/- – 7440/- (Pre-revised) without any Grade Pay. Such trainees are to be placed in the pay Band-I (5200-20200) with Grade Pay of Rs.1800/- only on acquiring the minimum qualification prescribed under the recruitment rules. However, under the 7th CPC, neither any specific pay Matrix/Level not the manner for fixation of pay in respect of MTS Trainee has been prescribed.

2. In this regard, it is intimated that matter already stands referred to the Ministry for furnishing necessary clarification/guidelines to regulate the pay fixation of trainees under Seventh CPC. Reply of the same is still awaited. As and when, replly is received from the Ministry, the same will be widelypublicized. Hence, it is requested to await for orders/clarification from the Ministry in the regard.

3. This is for your information and necessary action please.

(Kavita Garg)

Sr.Dy.CGDA (AN)

Source: www.cgda.nic.in

Monday 13 February 2017

RTP CAT CASE - AN UPDATE

DEPARTMENT SEEK TIME TO FILE AFFIDAVIT FOR RTP CAT CASE.

NEXT DATE OF HEARING IS 24.03.2017

Saturday 11 February 2017

Govt to open 56 Post Office Passport Seva Kendra facilities

Enthused by success of two pilot projects on utilising the head post offices as Passport Seva Kendra, the government has now decided to scale up this programme by opening 56 such facilities across the country.

The ministry of external affairs and the department of posts had earlier decided to join hands to deliver passport- related services to the citizens.

MEA and department of posts are working closely for the early commencement of passport-related services at such Kendras located in various states including Andhra Pradesh, Bihar, Chhattisgarh, Haryana, Jharkhand and West Bengal, the ministry on Tuesday said.

“Once fully functional, applicants who apply for their passports online through the Passport Portal will be able to schedule an appointment at these POPSK (Post Office Passport Seva Kendra) to complete the formalities,” the MEA said.

The pilot project between the MEA and Department of Posts had started in Mysuru and Dahod (Gujarat), on January 25.

“With the successful operationalisation of these two pilot projects, the Government has now decided to scale up this programme, by opening 56 POPSKs,” it said.

“The pilot projects of the Post Office Passport Seva Kendras (POPSK) have been running successfully at Mysuru and Dahod. We have been releasing 100 appointments for Mysuru and Dahod POPSK per day with cent per cent utilisation. Appointments for Mysuru (facilities) are now available in ten days while at Dahod it is available the next day,” the ministry said.

Subscribe to:

Posts (Atom)